Dubai Real Estate Market 2024: A Year of Record-Breaking Growth

According to data analytics provided by REIDIN, Dubai’s residential real estate market in 2024 has reached new heights, solidifying its position as a global property investment hub. With unprecedented transaction volumes and values, the market continues to attract international and local investors alike. Let’s dive into the highlights and key trends shaping this dynamic sector.

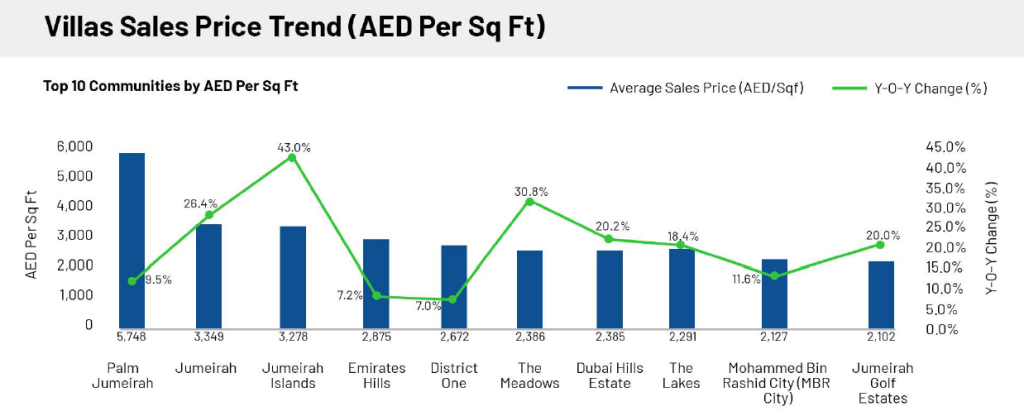

Robust Demand and Price Trends

The upward trend across all property types suggests a robust demand for residential properties in Dubai during 2024. Villas consistently maintain the highest price per sq. ft. compared to apartments and the general residential average. We also anticipate the price trends stabilizing over the next few years as more supply hits the market, for the majority of the market.

Record-Breaking Residential Transactions

The total residential transaction volume in 2024 surpassed 174,000, marking an impressive 39% year-on-year growth. The total value of residential transactions soared to AED 433.7 billion, reflecting a 33% increase compared to the previous year.

Key drivers behind this growth include:

- Apartment Price Growth: Popular areas such as DIFC and Dubai Marina saw significant price appreciation.

- Villa Demand: High demand for villas in premium communities like Jumeirah Islands, The Meadows, and Jumeirah Golf Estates.

Dominating Communities

Among the standout performers, Jumeirah Village Circle (JVC) recorded over 17,000 transactions, thanks to its relatively lower median sales prices of AED 1,300 per square foot. On the other hand, Business Bay captured attention with AED 24 billion in transaction value, driven by high-value deals despite a smaller volume of 10,690 transactions.

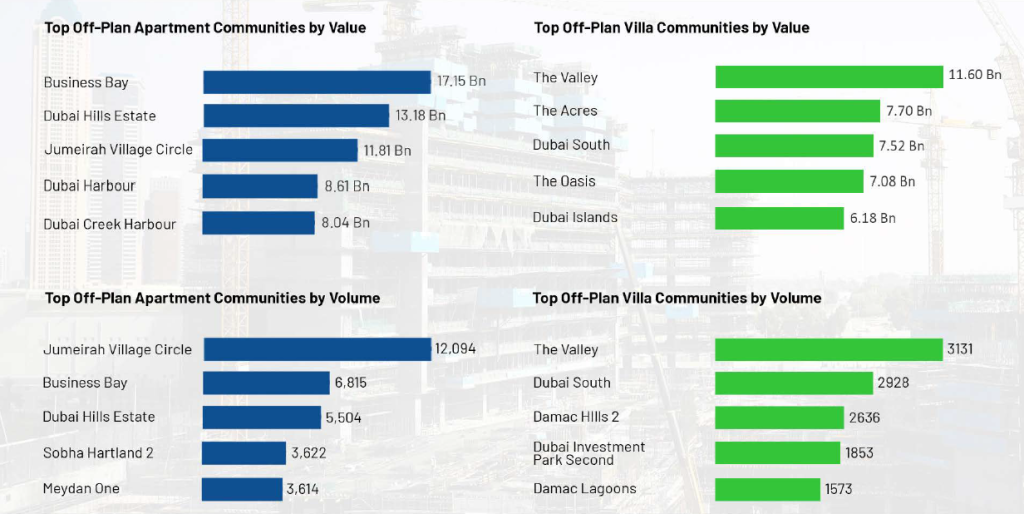

The Rise of Off-Plan Properties

Off-plan property sales hit record levels in 2024:

- Transactions: 119,000 sales, valued at AED 301 billion, accounted for 68% of total transaction volume, up from 61% in 2023.

- Project Launches: Over 588 projects by 238 developers were launched, highlighting the market’s vibrancy.

Notable contributors to the villa off-plan segment include:

- Emaar’s The Valley

- Damac Hills 2

- Dubai South (including Emaar South)

These projects collectively made up 25% of off-plan villa sales in 2024.

Developers with Highest Sales in Volume and Units Sold:

- Emaar Properties PJSC is the clear leader in the off-plan development market with a substantial value of AED 59.29 billion and 17,175 units sold. This indicates their strong market share and brand recognition.

- Damac Properties and Sobha Real Estate LLC are close competitors, holding the second and third positions with AED 25.52 billion and AED 23.66 billion, respectively. This suggests a competitive landscape among these major players.

- Companies like Binghatti Holding Limited, Majid Al Futtaim (MAF Group), Ellington Properties Development LLC, and Danube Properties are also making significant strides in the off-plan market, contributing to the overall growth of the sector.

Villa Market Dominance

Villa sales have emerged as a dominant force in the market:

- Total Value: AED 173 billion, contributing 40% of the market’s total value.

- Price Range: Properties priced between AED 2-5 million were particularly popular.

- Top Configurations: Four- and five-bedroom villas accounted for 63% (AED 109 billion) of total villa sales, while one- to three-bedroom villas contributed 19%.

The average price per square foot for luxury apartments also surged to AED 6,781, reflecting high demand for prime locations and premium finishes.

Supply Trends

The year saw the completion of over 30,000 units. However, delayed construction timelines pushed a significant portion of supply to 2025. This shift could influence market dynamics, potentially steering focus from off-plan to ready properties.

As of the beginning of 2025, Dubai is projected to deliver over 275,000 units during the 2025-2027 period, with 2026 expected (116,873 units) to mark a record high.

Government Initiatives Driving Growth

Government policies have been instrumental in fostering transparency and innovation in the real estate market:

- Dubai Real Estate Strategy 2033: Launched in October 2024, this ambitious plan aims to double the sector’s GDP contribution to AED 73 billion, grow transactions by 70%, and expand market value to AED 1 trillion. The strategy aligns with the Dubai Economic Agenda D33, emphasizing transparency and sustainable growth.

- Smart Rental Index: Introduced in January 2025, this AI-driven tool provides real-time rental valuations based on building classification, services, and maintenance standards, ensuring fairness for tenants and landlords.

Market Outlook

Dubai’s residential market remains vibrant, with the off-plan segment dominating transactions. The strong demand for luxury properties and the introduction of forward-thinking government policies highlight Dubai’s commitment to sustainable growth and innovation. Flexible payment plans continue to attract both investors and end-users, making Dubai a top choice for real estate investment in 2024 and beyond.

Sources:

REIDIN Data Analytics